From Credit Cards to Savings Accounts, Refugees Learn Financial Savvy from JFS Volunteers

By Rachel Nusbaum, HIAS.org

Apr 19, 2017

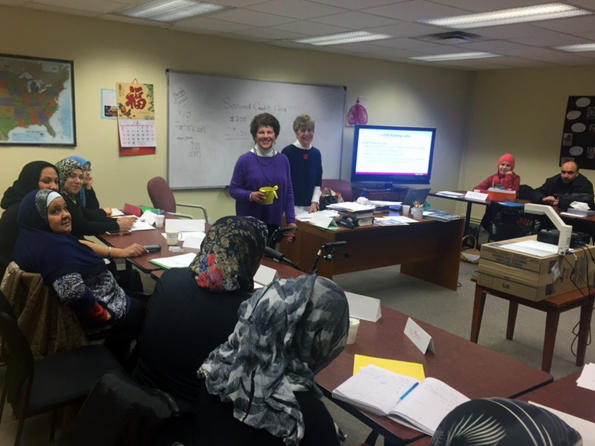

The first financial literacy class meets at JFS of Washtenaw County, in Ann Arbor, Michigan, facilitated by Marjorie Checkoway (L) and Susan Fisher (R).

(Hugh Goodman/JFS)

Marjorie Checkoway is no stranger to volunteer work. The Ann Arbor native has served on the board of her local JFS for nearly two decades, among other commitments. But when she heard about the financial literacy course for refugees offered by Jewish Family Services of Washtenaw County, she realized she needed to add one more activity to the roster.

“Part of my lifelong philosophy is helping and learning from other people. It's just a natural part of my lifestyle to volunteer,” she explained.

“I am a teacher, so I love working with students and learning from them and helping them out with new information and concepts,” Checkoway said. She relishes the opportunity to support new arrivals, showing them the tools they’ll need to get off to a strong financial start.

This includes everything from how to fill out a check to the difference between a credit and debit cards, to the broader concepts of budgeting.

“Making sure that you don’t overdraw and that you spend within your means, and trying to figure out right now on their limited income how they can operate in a comfortable way. I think those day to day things have been impactful,” Checkoway said.

There is a real need for this work among the refugee and immigrant community, in particular.

“Having lived for many years in unstable circumstances with few resources, many refugees have little or no experience in managing a regular household budget or saving for the future,” said Keith Combs, program manager for economic inclusion at HIAS.

“Refugees arrive with few or no assets, and after the first few months of assistance from a resettlement agency they find themselves responsible for paying their rent and bills with earnings from what is often, especially if they arrive with limited English, a low-wage job.”

Under such circumstances, “it can be easy to fall behind on payments and difficult to save for those things that are essential for advancement, such as a second-hand car to get a better job, a computer to facilitate the job search, or training classes to learn a new skill,” Combs explained.

So HIAS developed educational materials to promote financial literacy on crucial topics like budgeting, credit, financial institutions, and goal setting. The curriculum teaches refugees to calculate a simple budget, use online banking, set up a savings account, and more. HIAS provides the lesson plans and materials (which have been translated into French, Arabic, Burmese and Nepalese), but it is the volunteer facilitators who make the lessons come to life in the classroom with their refugee students.

“That we are learning about one another, human to human, and helping one another, supporting one another—I just think that is an important outcome. It's very rewarding and enjoyable,” Checkoway said.

The Michigan-based agency is currently on its fourth cohort of students, a group of nine skilled professionals that includes refugees from Iraq and Syria. By the end of March, 63 refugees will have completed financial literacy training through JFS.

Susan Fisher, president of JFS’ board, is another volunteer facilitator for the financial literacy course. She agreed with Checkoway’s assessment wholeheartedly.

“It seemed tailor-made, to do something that I would really enjoy and I could add value to,” said Fisher, who holds an MBA and a degree in accounting. “I thought it would be fun, and also very, very worthwhile.”

Fisher says it's the students themselves, “how new many of them are, the fact that they are working so hard to integrate themselves into this country,” who make running the trainings so worthwhile.

“You can see them gaining more and more confidence to ask questions as the classes go on. And I think that’s terrific because in order to be successful, they really have to understand bank accounts. And I had to spend a lot of time letting people know they could really trust our banks, because so many come from a place where they can’t,” Fisher explained.

Another vital concept Fisher stressed right away was saving. “I tell them that one of the things on their budget should be paying themselves. And that paying themselves is saving.”

“I thought I had a lot of answers, but there’s still a lot of questions that come up that I don’t have the answers for. So, you know, I think I’ve learned some things,” Fisher said.

“Including a robust financial literacy curriculum in our existing cultural orientation and English language instruction has empowered our participants with information about the financial system in the United States, so they can set and reach their financial goals,” said Shadin Atiyeh, employment programs manager at JFS.

“With the support of our dedicated volunteers, we hope to expand the program to support more refugees and other immigrants in reaching a higher level of financial well-being,” Atiyeh said.